2022 tax brackets

Detailed Massachusetts state income tax rates and brackets are available. The tax year 2023 maximum Earned Income Tax Credit amount is 7430 for qualifying taxpayers who have three or more qualifying children up.

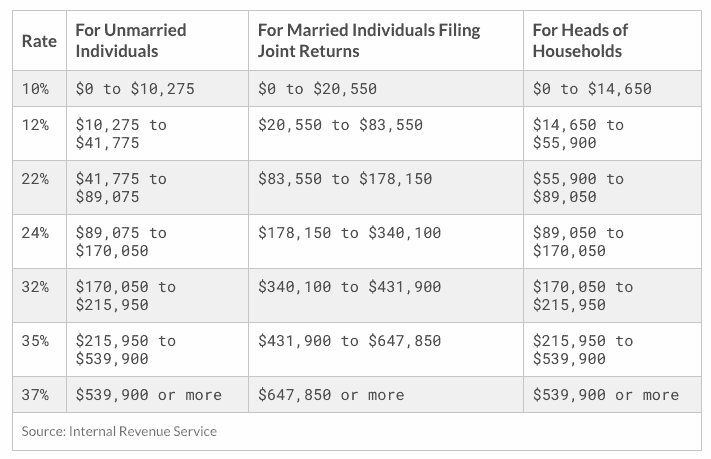

What Are The Income Tax Brackets For 2022

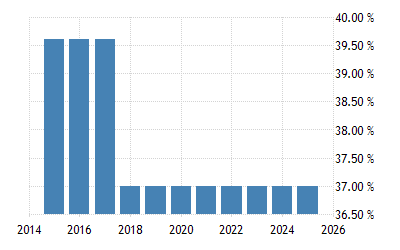

The seven tax rates remain unchanged while the income limits have been adjusted for inflation.

. Each of the tax brackets income ranges jumped about 7 from last years numbers. 50 personal income tax rate for tax year 2021. 6 hours agoThe IRS will slap a 12 marginal tax on individual filers earning more than 11000 and on joint married filers earning over 22000.

Federal Income Tax Brackets for 2022 Tax Season. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you.

Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals filing joint returns heads of households unmarried individuals married individuals. Download the free 2022 tax bracket pdf. 1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71.

A tax bracket is a range of incomes subject to a certain tax rate which is determined by your filing status and taxable. The agency says that the Earned Income. 6 hours agoOther increased tax benefits.

The 2022 and 2021 tax bracket ranges also differ depending on your filing status. Here is a look at what the brackets and tax rates are for 2022 filing 2023. Tax on this income.

2022 tax brackets are here. Working holiday maker tax rates 202223. The income brackets though are adjusted slightly for inflation.

2021 federal income tax brackets for taxes due in April 2022 or in. The personal exemption for tax year 2022 remains at 0 as it was for 2021 this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act. Tax brackets and rates for the 2022 tax year as well as for 2020 and previous years are elsewhere on this page.

The Massachusetts income tax has one tax bracket with a maximum marginal income tax of 500 as of 2022. Federal Income Tax Brackets 2022. For tax year 2021 Massachusetts has a 50 tax on both earned salaries wages tips commissions and unearned interest.

Heres a breakdown of last years income. Read on for more about the federal income tax brackets for Tax Year 2021 due April 15 2022 and Tax Year. 5 hours ago2022 tax brackets for individuals.

2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing. Working holiday maker tax rates 202223. The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up.

2 days agoThe document makes clear that it begins with the credits required to be issued for the fiscal year ending June 30 2022 First DOR will calculate the excess revenue percentage. This means that these brackets applied to all income earned in 2021 and the tax return that uses these tax. Whether you are single a head of household married.

There are seven federal income tax rates in 2022. The 2022 tax brackets affect the taxes that will be filed in 2023. Trending News IRS sets its new tax brackets.

For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. 1 hour agoFor 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

Irs Announces Inflation Adjustments To 2022 Tax Brackets Foundation National Taxpayers Union

United States Personal Income Tax Rate 2022 Data 2023 Forecast

Federal Income Tax Brackets For 2022 And 2023 The College Investor

Tax Changes For 2022 Including Tax Brackets Acorns

New 2022 Irs Income Tax Brackets And Phaseouts For Education Tax Breaks

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

Income Tax Brackets For 2022 Are Set

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Irs Tax Brackets 2022 Married People Filing Jointly Affected By Inflation Marca

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

New 2022 Tax Brackets Ckh Group

Don T Forget To Factor 2022 Cost Of Living Adjustments Into Your Year End Tax Planning Miller Kaplan

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Kick Start Your Tax Planning For 2023

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

2022 Tax Rates Brackets Credits Combined Federal Provincial Tax Brackets Manulife Investment Management